Trulieve: Strong Buy for this Top Marijuana Stock

Seize this opportunity to invest in this exciting, high growth potential cannabis stock

As the COVID crisis continues to dominate headlines, we’re becoming increasingly aware of the fact that many cannabis companies are set to deplete their cash as the markets grind to a halt in the coming months.

Why do we recommend Trulieve marijuana stock as a strong buy?

While the last twelve months have been an absolute nightmare for cannabis investors, there’s still a ton of potential opportunities in the cannabis industry. The winners and losers among the bunch are now becoming more and more evident. We believe Trulieve will be one of the winners.

In fact, MJ Business daily recently found that 8 of 33 cannabis firms it follows don’t have enough funding to last more than 10 months. The crisis will likely remain as an existential threat to the cannabis industry and will be an “extinction-level event” for many cannabis companies, according to MJ Biz Daily. Cannabis industry companies like Liberty Health Sciences, Tilray, and Aurora Cannabis, are among many marijuana stocks which are now down 50-90% in value over the past 12 months. Many of these worn-out cannabis companies simply don’t have the cash to survive.

Even though most marijuana businesses have been deemed as essential during the current COVID crisis, be aware of high levels of volatility for most marijuana stocks in the short term.

It’s worth noting that our Smart Stock Algorithm allowed our members to profit 30.1% for every dollar they invested in marijuana stocks in 2020 with our advanced signals – during the worst market downturns in marijuana stock investing history.

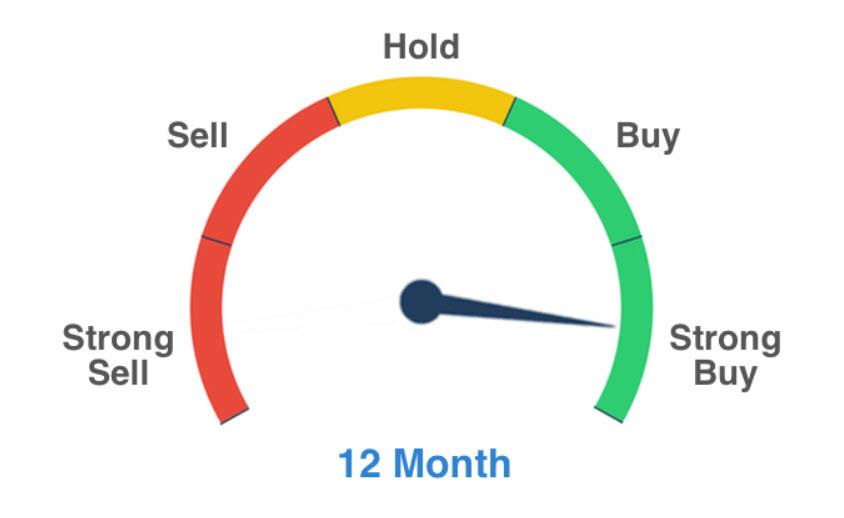

However, the long term outlook for many marijuana stocks and hemp stocks remains just as bright as ever. Specifically, long-term profitability for marijuana stocks like Trulieve Cannabis Corp. continues to remain incredibly promising. Our analysts believe that this is Trulieve is a Strong Buy for 2020.

What does Trulieve do?

Trulieve Cannabis Corp. (CSE: TRUL & OTCQX: TCNNF) engages in the production of cannabis products. The company cultivates and produces its products in-house and distributes cannabis products to its branded stores, as well as directly to patients via home delivery. Its products include smokable flower, inhalation, oral, sublingual, topical, inter-nasal, and concentrates. The company was founded on September 21, 2018, and is headquartered in Quincy, FL.

Trulieve Cannabis Corp. (CSE: TRUL & OTCQX: TCNNF) engages in the production of cannabis products. The company cultivates and produces its products in-house and distributes cannabis products to its branded stores, as well as directly to patients via home delivery. Its products include smokable flower, inhalation, oral, sublingual, topical, inter-nasal, and concentrates. The company was founded on September 21, 2018, and is headquartered in Quincy, FL.

Why is Trulieve a Strong Buy?

Strong Focus

Trulieve Cannabis Corp is a growth-oriented, licensed, vertically-integrated, seed-to-sale cannabis company headquartered in, and focused on, Florida, the third most populous state in the USA. It is the leading medical cannabis company there, with a significant market share of the state and 43 stores. They also have dispensaries in CA (1), MA (opening soon), and CT (1). Trulieve grows all its products in-house and distributes them to Trulieve-branded dispensaries in Florida, as well as directly to patients via home delivery. It manufactures approximately 300 SKUs (products), including smokable flowers, flower pods for vaporizing, concentrates, topicals, capsules, tinctures, and vape cartridges.

Strong Operations

Trulieve currently has 1.7 million sf of cultivation space on four sites, using both indoor and greenhouse facilities. It can now grow 30,000 kg of cannabis per year and is increasing its greenhouse capacity. It grows 45 cannabis flower strains and expects to grow revenue in Florida, as that state recently passed legislation allowing the sale of smokable cannabis flower. 27Trulieve produces 100% of the products sold in its Trulieve stores. It extracts 50,000 grams of active THC or CBD per week. It uses ethanol extraction mostly. It also uses CO2 extraction for terpene extraction and CO2 vaporizer products. It has a 55,000 SF building for production and shipping activities, with a kitchen for edible products and a hydrocarbon extraction facility, expecting the future legal sale of edible and hydrocarbon products in Florida.

Patients can order products for delivery on-line or by calling the Trulieve call-center, which takes roughly 2,000 calls per day. It offers next day delivery in most of Florida. Patients can also place orders for in-store pick-up online or via the call center. Store networks: It operates 43 of the 120 dispensaries in Florida (Florida allows 25 per licensee, plus five once a company reaches 100,000 active patients). Trulieve’s original 14 dispensaries which opened before the cap was enacted are grandfathered in, allowing them 39. Through February 2019, Trulieve had served nearly 215,000 unique patients in Florida.

Supply agreements: In December 2018, Trulieve bought Life Essence, a seed-to-sale cannabis company developing multiple locations in Massachusetts. Life Essence is applying for licenses to build and operate three medical dispensaries, three recreational stores, and a 126,000 SF cultivation facility.

Bottom Line: Is Trulieve a Good Marijuana Stock Investment?

Trulieve has a very strong position in Florida, the third-largest US medical cannabis market. They have 43 dispensaries, produce 30,000 kgs per year and, based on Q4 2018, are currently on a revenue pace of more than $200 million per year.

They plan to also expand their growing capacity in Florida though they have not specified how much. But they have bought businesses in MA and CA — and the one in MA has enough grow space to boost their output to 45,000 kgs per year in the coming few years. This should increase their revenue by 50%, taking them close to $300 million.

This looks like a strong plan to increase revenue growth for the company. The question is, is this revenue already priced into their stock? Or will the stock price grow as revenue grows? By our calculations, the company has a price to sales ratio of 4.3 —about the average in the tobacco industry. This is a great sign for them and shows any revenue growth should drive the stock price higher. They maintain over 50% market share in Florida, have over 500% revenue growth year over year and have 300+ SKU’s. All this means fantastic growth is ahead. Combine this with the fact they gave back a lot of momentum in 2019 and 2020 should be a perfect year to gain it all back, and more.

For investors who don’t mind waiting a year for a solid return, we think Trulieve at its current price presents an excellent opportunity for long-term gain especially with some COVID recovery priced in!

Trulieve: Strong Buy for this Top Marijuana Stock

About Cannin: Your Marijuana Investment Experts

Market analysts expect the marijuana and hemp industry will have an annual value exceeding $75 Billion in the next decade. The time to invest in hemp and marijuana stocks is now. Are you looking to buy stock in hemp companies or marijuana companies? Interested in emerging penny pot stock companies? Looking for the best Canadian marijuana company to invest in?

Cannin is your trusted resource for information about Marijuana and Hemp stock investment opportunities. Our global team of experts evaluates hundreds of emerging marijuana stock investing opportunities. We aggregate hundreds of hours of research and provide tips on the best marijuana stock investments for 2020. We provide the latest marijuana investment and hemp investment news and analysis.

Visit our site for breaking cannabis investing news and featured companies, sign up for the free Cannin Chronicle, or get a free trial of our smart marijuana stock algorithm to take the guesswork out of profiting from this exciting industry. Predict the price of marijuana stocks hours in advance with our proven machine learning algorithm. Is it too late to invest in Trulieve? No! This is the perfect time to invest.

Profit from the best marijuana stocks – we’ll show you how at cannin.com