Featured Cannabis Stock Pick for 2020: Curaleaf Holdings, Inc.

Large, vertically integrated Multi-State Operators (MSO) can be exciting cannabis stock investment opportunities given their potential trajectory. MSO cannabis companies like Curaleaf own several market verticals in key legal states. But why is Curaleaf one of our Featured cannabis stock picks for 2020?

Curaleaf Holdings, Inc. (OTC: CURLF) engages in operating licensed, vertically integrated cannabis businesses that cultivate, process and dispense cannabis and cannabis-derived products. The Cannabis segment focuses on the production and sale of cannabis. The Non-Cannabis segment provides non-cannabis services to licensed cannabis operators in the areas of cultivation, extraction, and production, and retail operations. But is this one of the 3 best cannabis stock picks for 2020?

Why do we like Curaleaf Holdings as a featured cannabis stock pick for 2020?

- Strong Focus: Curaleaf operates and owns 12 cultivation sites, 28 dispensaries and 9 processing sites with a focus on highly populated, limited license states, including Florida, Massachusetts, New Jersey, and New York. Curaleaf leverages its extensive research and development capabilities to distribute cannabis products in multiple formats. They are focused on patient education, physician engagement and community outreach to build a national retail brand.

- Strong Branding: Curaleaf has become the most accessible national cannabis brand with the largest operational branded dispensary footprint in the country and the recent launch of our CBD line under Curaleaf Hemp. Their strategic presence in highly populated, limited license states, which has served as an important foundation for aggressive expansion plans across the country.

- Strong Financing: Curaleaf raised approximately C$520 million (US$400 million) in an oversubscribed private placement offering led by GMP Securities L.P. and Canaccord Genuity Corp. (the “Co-Lead Agents”), on behalf of a syndicate of agents, including Cormark Securities Inc., Eight Capital, and Haywood Securities Inc.

Why do we Recommend Curaleaf Holdings as one of the best cannabis stock picks for 2020?

CuraLeaf Holdings operates an integrated network of medical and wellness cannabis facilities throughout the United States. CuraLeaf cultivates, processes, markets, and dispenses marijuana products in a range of forms, including flower, pre-rolls, and flower pods, dry-herb vaporizer cartridges, concentrates for vaporizing, concentrates for dabbing, tinctures, lozenges, capsules, and edibles. Multiple product formats provide an array of administration options, including inhalation, ingestion, sublingual, and topical.

CuraLeaf is one of a very large group of operators to successfully obtain cultivation licenses in more than one of the modern, limited license, merit-based application state programs. Recently, they pulled back on their Cura Partners deal to 55 million shares down from 95.5 million shares. This lower value is the current reality for many cannabis deals.

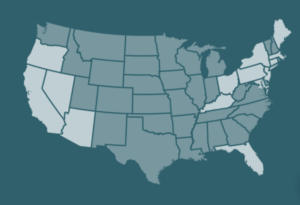

CuraLeaf also provides non-cannabis management and consultative services to licensed cannabis operators, to assist with cultivation, extraction, production, and retailing. Founded in 2010, CuraLeaf currently operates a network of 34 dispensaries, 12 cultivation sites, and 10 processing sites in 12 states.

CuraLeaf Holdings was the largest marijuana initial public offering (IPO) ever, with the company temporarily boasting a lofty valuation of more than $4 billion, after its debut in late October. Managed Revenue grew to $87.8 million in full-year 2018, up 209% on a year-over-year basis, and Total Revenue increased 298%, driven by a combination of organic growth and acquisitions.

CuraLeaf is currently improving its finances as net income is on a downward slope. In the fourth quarter of 2018, despite growing revenue, the company reported a net loss of $16.5 million, compared to net income of $628,000 in the same quarter a year ago.

Will its stock price improve in the long term? We think so. The low price of 4.70 is pretty fair considering revenue projections for 2020.

There’s a bull case, and it’s persuasive. A strong capital position with $266.6 million cash on hand at year-end, supported by a prudent capital allocation strategy is focused on strategic acquisitions and rapid store expansion. CuraLeaf should start to see an improved bottom line, as it generates synergies throughout the marijuana supply chain.

The company currently covers 70% of the U.S. cannabis market, reaching 134 million of the addressable population.

For these reasons, we think CuraLeaf, at or near its current price of $4.70 a share, is a very good investment opportunity. Watch the P/S ratio also dropping over the last six months; very telling!

Featured Cannabis Stock Pick for 2020: Curaleaf Holdings, Inc.

See our Full Analysis of Curaleaf Here.

About Cannin: Cannabis and Hemp Investment Experts

Market analysts expect the cannabis and hemp industry will have an annual value exceeding $75 Billion in the next decade. The time to invest in cannabis and hemp stocks is now! Are you looking to buy stock in hemp companies or cannabis companies? Interested in emerging penny pot stock companies? Looking for the best Canadian pot company to invest in? Cannin is your trusted resource for information about Cannabis and Hemp stock investment opportunities. Our global team of experts evaluates emerging cannabis stock investing companies. We aggregate hundreds of hours of research and distill it down to make it easy for our investors to understand. We provide tips on the best cannabis and hemp stock investments for 2020. We provide the latest hemp investment news and analysis. Visit our site for cannabis investing news and featured companies, sign up for the free Cannin Chronicle or get a free trial of our smart cannabis and hemp stock algorithm to take the guesswork out of profiting from this exciting industry. Predict the price of cannabis and hemp stocks hours in advance with our machine learning algorithm. Is it too late to invest in marijuana? No! This is the perfect time.

Profit from the best Cannabis and Hemp stocks – we’ll show you how at cannin.com